Do you need to open a bank account for kids, but you're not sure where to start? We’ve got you sorted!

The Australian economy might be experiencing some of its darkest days, and it can be hard to know who to trust when it comes to our children's hard-earned pennies but don't worry; we’ve scanned all the websites of the big banks and not-so-big banks to bring you options for some of the best bank accounts for kids in 2025.

Please note: This is factual information and is not intended as a recommendation or statement of opinion. Consider seeking financial advice based on your circumstances before making any financial decisions. Information is current at the time of publication: February 2025.

The Best Bank Accounts for Kids in 2025

1. St George Bank | Incentive Saver

The St George Incentive Saver account for kids is a fun and rewarding way to help your child start building their financial future. Kids can earn up to 5.25% p.a. with a variable base rate of 1.85% p.a., a variable bonus rate of 3.30% p.a., and an extra 0.10% p.a. to your variable bonus rate for the first 3 months when you open online.

Designed to encourage smart saving habits, this account offers bonus interest when savings goals are met—making it a playful way to turn saving money into an exciting challenge. With no monthly fees and easy-to-use digital tools, it's perfect for young savers and gives parents peace of mind. Empower your child to learn about money management while enjoying a supportive, engaging banking experience that makes every dollar saved feel like a victory!

2. First Option Bank | Kids Bonus Saver

Offering big interest for little people, the Kids Bonus Saver from First Option Bank is designed exclusively for those under 18 and rewards you with bonus interest when you deposit at least $5 each month and make no withdrawals. With easy access through internet banking or the mobile app, you can watch your money grow while learning great saving habits.

Enjoy a base interest rate of 0.05% per annum on balances up to $5,555, which boosts to an impressive 5.50% per annum when you meet the deposit requirement. Start saving smart with the Kids Bonus Saver and see how little contributions can lead to big rewards!

3. People's Choice | Young Saver

The People's Choice Young Saver account is another one of the best bank accounts for kids in 2025.

There's no need to worry about minimum opening deposits or monthly fees, and you can enjoy competitive interest rates and even earn bonus interest when you make regular deposits without withdrawals. Plus, you'll have 24/7 access through their convenient Mobile Banking App and Internet Banking. It's the perfect way for young savers to start growing their money!

This account has an interest rate of 0.10% p.a.—but if you deposit a minimum of $5 and make no withdrawals in any month, you can earn bonus interest to the tune of 5.05% p.a. Talk about an incentive!

4. Great Southern Bank | Youth eSaver

It's never too early to start saving! The Great Southern Bank Youth eSaver everyday online bank account for kids is designed for kids from newborn up to 17 years and provides a generous interest rate of 5.5% p.a. on balances up to $5,000, then at 1.00% p.a. on the balance.

This flexible bank account has no ongoing account fees or banking free and unlimited free withdrawals. Plus, kids can access their savings without affecting their interest rates.

A parent or guardian will have to authorise the account opening and be listed as a signatory for children under 10, however, kids from 10 to 17 years old can apply independently as the main account holder - very grown up and an important milestone in their journey to financial autonomy.

How Your Child Can Learn to Manage Their Own Money

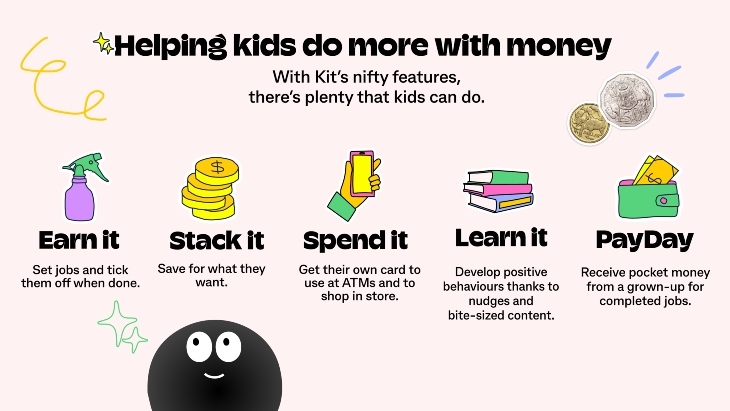

Kit is an innovative app owned by CommBank, built especially for kids and designed to deliver the best money experience possible for young Australians.

Kit helps kids get hands-on financial education experience, promotes mindful spending, and gives them autonomy and ownership of their money. The 'earning-and-learning' platform also imparts bit-sized (but effective!) lessons to help kids on their journey toward money-mastering, with features including savings stacks, PayDay and ‘nudges’ that encourage them to achieve their goals.

Kit has adopted a scientific approach to help little learners build financial independence and confidence. With their own fun, customisable Kit Account and a digital and physical prepaid card, savvy savers can easily manage their own earnings and spending, and watch their savings grow!

Piggy Banks for Kids and Other Important Things to Consider

Recently we discovered (the hard way) that many of the Big Banks no longer have coin machines - incredibly disappointing! I have strong childhood memories of taking my piggy bank into the branch, and I loved seeing the numbers on my passbook grow! For me, this is a missed opportunity for kids. ANZ request that you count and bag the money yourself before coming to their branches. Some parents with older children may still find value in this exercise.

Did you know St George no longer has Happy Dragon Accounts - bye-bye friendly green dragon - and CBA has dropped the most famous of all kids' accounts – the Dollarmite? Plus, school banking programs are no longer supported in NSW public schools as of this year.

According to The Barefoot Investor, banks will automatically offer your child their first credit card at 17. This is not something I want for my kids personally, so you might want to watch out for that too!

Be mindful that many banks will require the parents/guardians to also hold an account with them first before allowing them to open a bank account for a child. Of course, adult accounts almost always attract fees and charges, so it's best to understand what that will cost you and what the restrictions (if any) will be.

And finally, remember, it's okay to change as many times as you like. Gone are the days of personal relationships with your local bank manager. Banks constantly change their rates, so don’t be frightened to follow the best rates and change accounts/banks as you see fit. At the end of the day, it’s about creating the best wealth for your children.

Taxation of Interest Earned on Bank Accounts for Kids

Please note that special rules are in place for the taxation of interest earned on bank accounts for kids, so please refer to the Australian Taxation Office for details.

More Parenting Tips

Sleep Patches for Kids: A Parent's Guide

Calling All Parents: Unlock the Secret to Scientifically Proven Better Sleep

Easy Self-Care Ideas For Busy Mums

Have you signed up for our newsletter? Join ellaslist to get the best family and kid-friendly events, venues, classes and things to do NEAR YOU!

Reviews

Stephanie

Feb 10 2021

This information is so useful, thank you! Opening the kids bank accounts has been on the to-do list for so long and am excited to now make it happen.

Lucinda

Oct 23 2020

I found this site really informative, easy to understand and straight forward. I am looking into the best places to bank with when it comes to a long term savings account for my 4yo. t was oblivious to how manipulative and ingenious some banks can be when it comes to trusting our children and savings. As well as what it means for us parents in regard to the ATO. So thank you opening my eyes as I’ll definitely be doing a lot more research into savings, banks and taxes for both my child and myself.

Ally Edwards

Jan 08 2020

hi, this information was helpful and backed up other sources I've been reading, so thank you. i think the person in the ads was Julie Anthony though.

Pick a Date

Pick a Date